Boasting a rich history, diverse culture, and mouthwatering Tex-Mex cuisine, San Antonio had long been on my bucket list. To ensure a smooth and enjoyable journey, I meticulously planned every aspect of my trip, from selecting the right airline to assessing the amenities at the airports in both San Antonio and my departure city. I’ll take you through the importance of travel insurance, provide tips on securing affordable coverage, highlight key considerations, and recommend specific insurance providers to ensure your peace of mind when planning your trip to San Antonio, Texas.

The Importance of Travel Insurance

Before delving into the intricacies of travel insurance, it’s crucial to understand why it’s an essential component of any travel plan.

Protection against Trip Cancellation or Interruption

Imagine this scenario: You’ve meticulously planned your San Antonio vacation, but a family emergency forces you to cancel your trip or return home prematurely. Travel insurance can cover the costs of non-refundable reservations, allowing you to reschedule your trip without incurring substantial financial losses.

Medical Coverage

Accidents or illnesses can strike anywhere, including while you’re on vacation. Without adequate insurance, you might find yourself facing exorbitant medical bills. Travel insurance provides medical coverage, ensuring that you receive the care you need without breaking the bank.

Delayed or Lost Baggage

Misplaced or delayed luggage can put a damper on your travel experience. Travel insurance can provide compensation for essential items you need while waiting for your belongings to be returned to you.

Emergency Evacuation

In rare cases, you may find yourself in a situation that requires emergency evacuation due to natural disasters or political unrest. Travel insurance can cover the costs of such evacuations, ensuring your safety.

Tips for Securing Affordable Travel Insurance

Now that you understand the importance of travel insurance, let’s explore some tips to help you find affordable coverage for your San Antonio trip.

Start Early

Don’t wait until the last minute to purchase travel insurance. The earlier you secure coverage, the more options you’ll have, and you may even benefit from lower premiums.

Compare Multiple Providers

Just as with booking your flights and accommodations, shopping around for travel insurance is essential. Compare quotes from multiple insurance providers to find the most competitive rates.

Consider Annual Policies

If you’re a frequent traveler, an annual travel insurance policy may be a cost-effective choice. These policies cover multiple trips within a year, often at a lower overall cost than purchasing insurance for each trip individually.

Customize Your Coverage

Not all travelers have the same needs. Consider customizing your travel insurance to include only the coverage you require. This can help you save money by avoiding unnecessary add-ons.

Check Your Existing Coverage

Before purchasing travel insurance, review your existing insurance policies. Some health or homeowner’s insurance plans may already provide certain travel-related coverage, potentially saving you from doubling up on coverage.

Key Considerations

When seeking travel insurance, there are essential factors to keep in mind:

Trip Cancellation Reasons

Be aware of the specific reasons that would allow you to cancel your trip and receive reimbursement. Most policies cover unforeseen events such as illness, injury, or a family emergency, but others may have more limited cancellation reasons.

Pre-Existing Medical Conditions

If you have pre-existing medical conditions, it’s crucial to disclose them when purchasing insurance. Some policies may exclude coverage for pre-existing conditions unless you purchase a waiver, while others may offer coverage with certain conditions.

Claim Procedures

Understand the claims process and what documentation is required if you need to file a claim. This will help you navigate the process more smoothly in the event of an incident.

Emergency Contact Information

Carry your insurance policy details, including emergency contact information, with you while traveling. Having this information readily available can be a lifesaver in a medical emergency.

Allianz Global Assistance:My Experience

I decided to go with Allianz Global Assistance for my recent trip to San Antonio, and it turned out to be a wise choice. As a well-established insurance provider, they are known for their comprehensive travel coverage options, and they offer a variety of plans to cater to different travel needs.

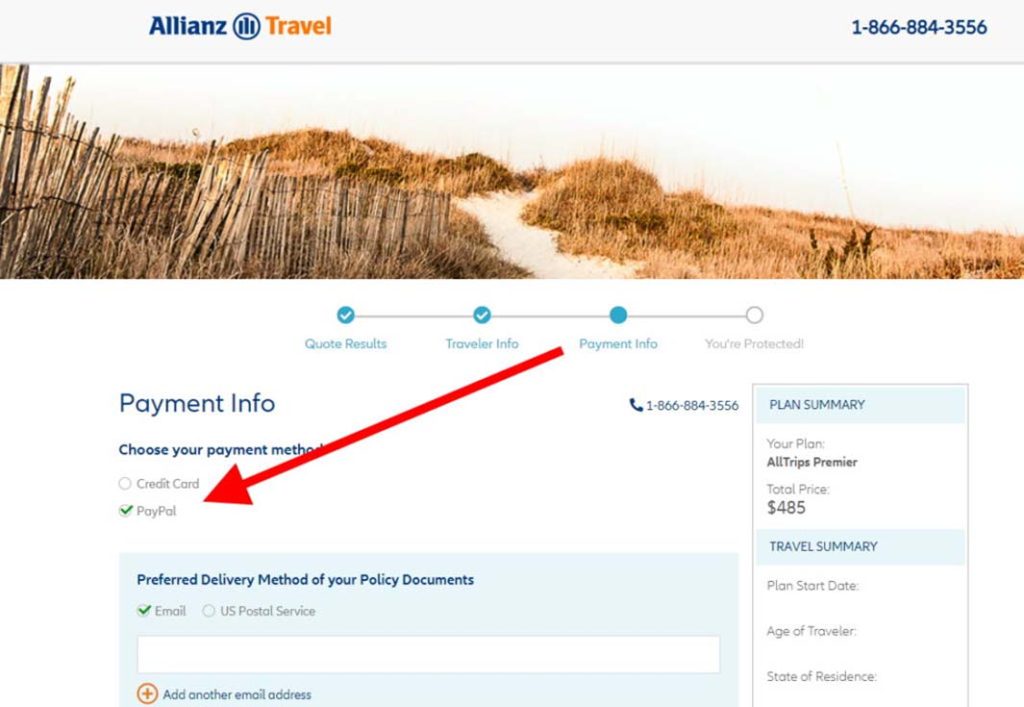

The process of getting a quote and purchasing coverage through Allianz was incredibly user-friendly. Their website is well-designed, making it easy to navigate and find the information I needed. I appreciated the transparency in their offerings, which allowed me to select the plan that best suited my travel requirements.

During my trip, I had a minor medical issue that required a doctor’s visit. Having purchased travel insurance from Allianz, I was relieved to know that I had medical coverage in case of such situations. When I contacted their customer support for guidance on medical facilities in San Antonio, they were not only helpful but also provided me with a list of nearby clinics, which was a great relief.

Thankfully, the medical issue was resolved without any major complications, but the peace of mind that Allianz Global Assistance provided was invaluable. It’s a comfort to know that you have a safety net when traveling, especially in a place far from home.

My experience with Allianz Global Assistance was positive. Their user-friendly website, comprehensive coverage options, and responsive customer support gave me the confidence to explore San Antonio without constantly worrying about unexpected issues. Travel insurance is one of those things you hope you won’t need, but having it is a prudent decision, and Allianz proved to be a reliable choice for my San Antonio adventure.

Recommended Travel Insurance Providers

I recently conducted a comprehensive comparison of travel insurance providers, and two companies stood out as excellent choices, even though I didn’t end up using their services. Here’s a detailed look at TravelGuard and World Nomads.

I recently conducted a comprehensive comparison of travel insurance providers, and two companies stood out as excellent choices, even though I didn’t end up using their services. Here’s a detailed look at TravelGuard and World Nomads.

TravelGuard

TravelGuard is a well-established name in the travel insurance industry, and it’s not hard to see why. They offer a wide range of plans tailored to various travel needs, making them a versatile option for different types of travelers. Whether you’re a business traveler, an adventure enthusiast, or planning a family vacation, TravelGuard has you covered.

One standout feature is their 24/7 customer support and emergency assistance. Knowing that you can reach out for help at any time, especially during unexpected situations, provides a sense of security that’s invaluable while traveling. Although I didn’t need to use their services during my trip to San Antonio, having that safety net in place was reassuring.

World Nomads:

World Nomads, on the other hand, is a top choice for adventurers, particularly those who love outdoor and off-the-beaten-path activities. Their coverage is designed with the more intrepid traveler in mind. What makes World Nomads truly unique is their flexibility. You can purchase and extend your policy even while you’re already abroad. This feature is incredibly convenient for those who extend their trips or make impromptu travel plans.

Furthermore, World Nomads provides coverage for a wide range of pre-existing medical conditions, which can be a game-changer for travelers with specific health needs. While I didn’t require such coverage during my San Antonio trip, knowing it was available from a reputable provider like World Nomads was reassuring.

After conducting a thorough comparison of TravelGuard and World Nomads, it’s clear that both insurance providers offer valuable coverage for travelers. However, each has its own set of strengths and unique features, catering to different types of travelers.

TravelGuard stands out for its wide range of plans, making it an excellent choice for various travel needs. Whether you’re a business traveler, planning a family vacation, or seeking adventure, TravelGuard has options that suit your requirements. Their 24/7 customer support and emergency assistance are significant advantages, providing peace of mind during unexpected situations.

On the other hand, World Nomads specializes in catering to adventurous travelers, especially those engaging in outdoor and off-the-beaten-path activities. Their flexible coverage, which allows you to purchase and extend your policy while already abroad, is a standout feature. Additionally, their coverage for a broad range of pre-existing medical conditions is a game-changer for travelers with specific health needs.

It’s important to consider your travel style and specific requirements when choosing between these two providers. If you’re embarking on an adventure and value flexibility, World Nomads may be the better option. On the other hand, if you’re looking for comprehensive coverage that suits various travel scenarios and need reliable customer support, TravelGuard could be the more suitable choice.

When planning your trip to San Antonio, investing in travel insurance is a decision that ensures your peace of mind. It offers protection against unforeseen events and allows you to enjoy your journey without worrying about unexpected expenses.

By following the tips for securing affordable coverage, keeping key considerations in mind, and exploring reputable insurance providers like Allianz Global Assistance, TravelGuard, and World Nomads, you can embark on your San Antonio adventure with confidence, knowing that you’re protected should the unexpected occur. Safe travels, and may your trip be filled with unforgettable moments and cherished memories!